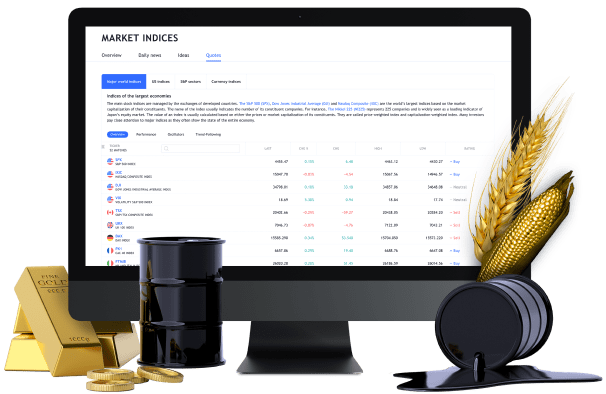

Trade a range of commodities, including crude oil. CFDs on commodities offer plenty of trading opportunities due to their low or negative correlations. Buy and sell CFDs on commodities and benefit from competitive spreads and flexible leverage across our whole commodity range.

CFDs allow you to buy (go long) or sell (go short). So, you can make a profit when the commodity falls in value, not just when it rises. However, you can also take a loss from price movements.

Deep liquidity and protection against inflation add to the appeal of this asset class for both beginners and professional traders.

Commodities have low correlation with stocks. Therefore, trading commodities is a great way to diversify your portfolio and hedge against risk.

Most commodity markets are open on a 24-hour basis so you can trade 24 hours a day, 5 days a week.

Keep your costs down with spreads from 3 points.

Deep liquidity and protection against inflation add to the appeal of this asset class for both beginners and professional traders.

Commodities have low correlation with stocks. Therefore, trading commodities is a great way to diversify your portfolio and hedge against risk.

CFDs allow you to buy (go long) or sell (go short). So, you can make a profit when the commodity falls in value, not just when it rises. However, you can also take a loss from price movements.

Most commodity markets are open on a 24-hour basis so you can trade 24 hours a day, 5 days a week.

Keep your costs down with spreads from 3 points.

Commodity prices are determined by fundamental factors like weather, strikes and geopolitical instability which affects the supply and demand of commodities.

Commodity prices rise with increasing demand, and also when the overall supply falls. On the other hand, the price of a commodity will fall when there is decreasing demand and increasing supply.

Commodities are generally priced in USD. As the value of the USD rises and falls, so can the price of commodities. For example, if the USD experiences a sharp increase against a basket of major currencies the prices of commodities such as crude oil and other energies.

Some commodities like crude oil are mainly produced in countries around the Middle East that experience political uncertainty. Therefore, the price of Brent, for example, can be heavily influenced by tensions that occur in the region.

The economic growth of a country can also affect the price of a commodity because economic growth determines the purchasing power of its population.

Commodity prices rise with increasing demand, and also when the overall supply falls. On the other hand, the price of a commodity will fall when there is decreasing demand and increasing supply.

Some commodities like crude oil are mainly produced in countries around the Middle East that experience political uncertainty. Therefore, the price of Brent, for example, can be heavily influenced by tensions that occur in the region.

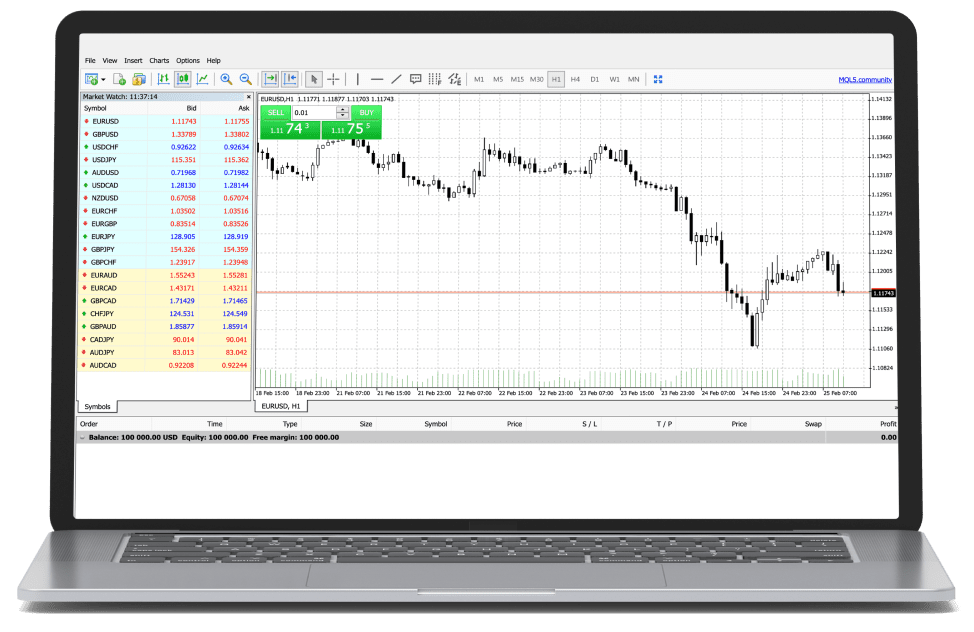

Trade CFDs on commodities on the MetaTrader 4 platform and get instant access to advanced charting and indicators.

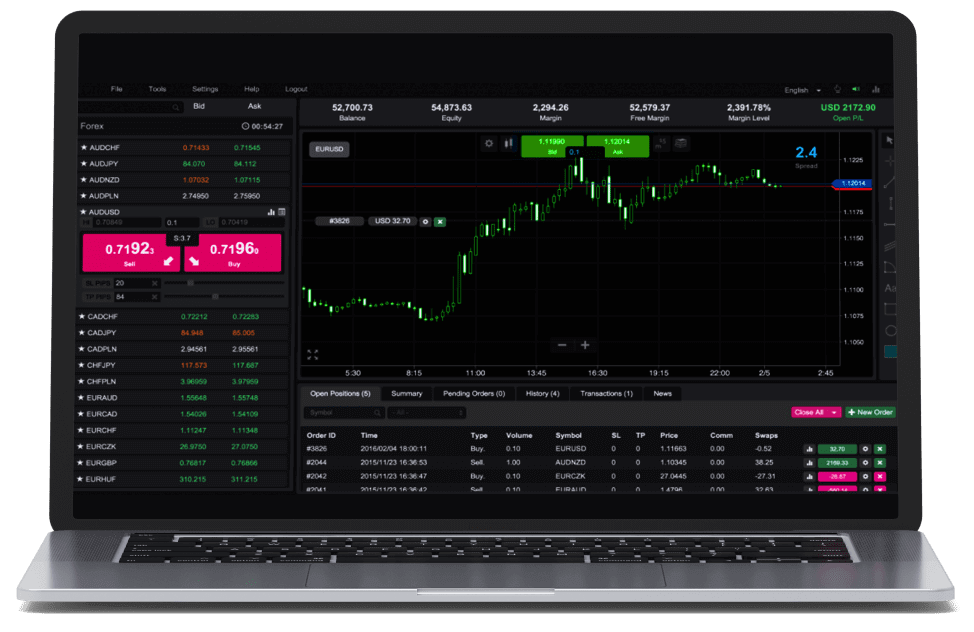

WebTrader is a 100% web-based platform, providing full functionality via a user-friendly interface.

Forex

Metals

Indices

Commodities

Futures

Shares

Forex

Metals

Indices

Commodities

Futures

Shares

T4Trade, with registered address of F20, 1st Floor, Eden Plaza, Eden Island, Seychelles, is a trade name of Tradeco Limited.

Damadah Holding Limited, with registered address of 365 Agiou Andreou, Efstathiou Court, Flat 201, 3035 Limassol, Cyprus, facilitates services to Tradeco Limited, including but not limited to payment services.

Tradeco Limited is authorised and regulated by the Seychelles Financial Services Authority with licence number SD029.

Risk Warning:

Our products are traded on margin and carry a high level of risk and it is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved.

T4Trade is not targeted to residents of the EU where it is not licensed. T4Trade does not offer its services to residents of certain jurisdictions such as USA, Iran, Cuba, Sudan, Syria and North Korea.

Legal Documents

Thank you for visiting T4Trade

This website is not directed at EU residents and falls outside the European and MiFID II regulatory framework.

Please click below if you wish to continue to T4Trade anyway.

Thank you for visiting T4Trade

This website is not directed at UK residents and falls outside the European and MiFID II regulatory framework, as well as the rules, guidance and protections set out in the UK Financial Conduct Authority Handbook.

Please click below if you wish to continue to T4Trade anyway.