It has been a rough week of crude oil prices as a plethora of converging fundamentals weighed negatively on the commodity. WTI, the dollar denominated benchmark for oil prices, slumped to the $72 dollars per barrel yesterday, its lowest level for the year, as echoing worries for severe economic downturns across the globe which foreshadow a possible suppression of the demand outlook for the commodity. It is certainly a crucial period for oil prices as a plethora of converging catalysts such as China’s recent gradual reopening announcement, OPEC+ decision to maintain output supply cuts throughout 2023 and European Union’s finalized $60 per barrel price cap on Russian crude, all influence the commodity’s price action in their own way. This report aims at analyzing the fundamental drivers influencing WTI’s price action and seeks to assess its future outlook and conclude with a technical analysis.

Wall Street bankers’ comments shake the markets

Earlier this week, a parade of US banking CEOs painted a bleak picture for the future outlook of the US economy, sounding the alarm bell for an impending recession. JPMorgan Chase CEO Jamie Dimon, unleashed mayhem on the markets with his stark comments as he foresees at least a mild or worse, a hard recession hit the US economy next year. Among the list of factors that led to his case are the deteriorating economic conditions being tarnished by persistently elevated inflationary pressures alongside the aggressive overtightening efforts from the Federal Reserve, both of which erode consumers’ purchasing power. Among others, CEOs from prominent banks such as Goldman Sachs and Bank of America, stated that they foresee negative growth in the first part of 2023 and hinted at job and bonus cuts as well as freezing the hiring processes. The grim outlook weighed as a result on oil prices since deteriorating economic conditions and below trend growth projections bring a toll on the demand side of the commodity.

OPEC+ maintains initial supply cut decision

The oil cartel at its latest meeting decided to continue forth with the existing output supply cuts of 2 million barrels per day throughout 2023, announced in October, yet in the joined statement it was explicitly written that the group has “the ability to take further measures, if required, to achieve balance dan stability in the market”. Comments of similar nature were made in the past by the Qatari head of OPEC, Haitham Al Ghais as well as the Saudi energy minister Abdulaziz bin Salman al Saud, signaling to the market that the group remains vigilant, ready to intervene should prices deviate substantially from the cartels’ target range. The divergence of oil prices from market fundamentals has been a point of reference in recent months from the group, which vowed to restore order and achieve price equilibrium. On another note, on Wednesday, the China’s President Xi Jinping travelled to Saudi Arabia discussing the possibility for oil related bilateral agreements between the two nations at a critical period. It would be interesting to monitor further developments and news announcements for a potential alliance, as in recent months the long-standing relationship between the Gulf nation and the West have been unstable over criticism of human rights violations and the timing of the 2-million-barrel supply cut announcement a week prior of the US midterm elections. Yesterday, Saudi officials signaled that the kingdom is actively seeking to expand partnerships to serve economic and security interests, irrespective of the recent warnings drawn from the West, criticizing the dealings between nations of the Gulf with both China and Russia. Should an agreement materialize, where Saudi Arabia is to supply the oil consuming giant China, we may see oil prices receive support.

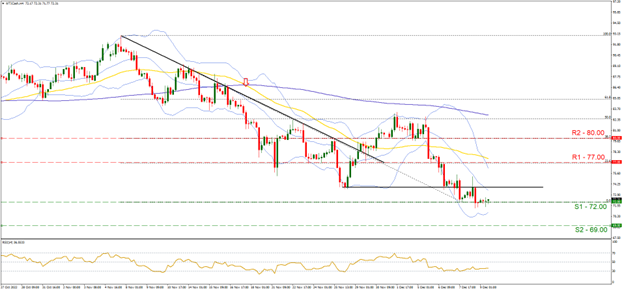

Analisis Teknikal

WTI Cash H4

Looking at WTICash 4-hour chart we observe oil prices losing significant ground, plummeting to their year-to-date lows and currently the price action flirts with the 72.00 support base. We hold a bearish outlook bias for the price action of the commodity given the descending trendline alongside the death cross formed on the 17th of November, noted with the red arrow on the chart, validating its downward extension. Furthermore, supporting our case is the RSI indicator below our 4-hour chart that currently registers a reading of 33, highlighting the bearish sentiment surrounding WTI. Should the bears continue to navigate the direction of the commodity, we may see the definitive break below the 72.00 (S1) support level and the price action moving lower, closer to the 69.00 (S2) support base, a level once seen before on the 21st of December 2021. Should on the other hand, the bulls take over the initiative we may see the price action reverse course and head towards the 77.00 (R1) resistance level (23.6% retracement). On a more extreme scenario we would expect the price action to break past 77.00 (R1) level and head closer to the 80.00 (R2) resistance barrier (38.2% retracement).

Penafian: This material is for general informational & educational purposes only and should not be considered as investment advice or an investment recommendation. T4Trade is not responsible for any data provided by third parties referenced or hyperlinked, in this communication.